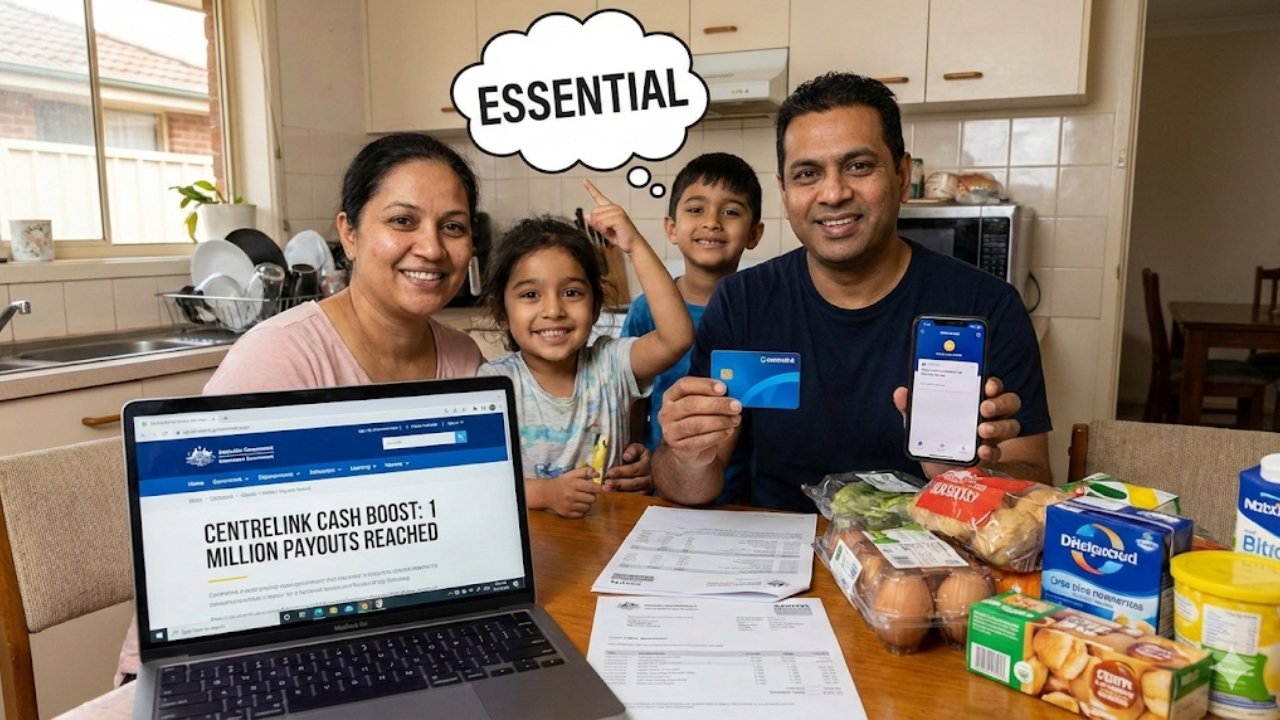

Australian families breathed a sigh of relief as Centrelink rolled out its advanced cash boost, reaching one million payouts in the past year. This timely support targets back-to-school expenses and everyday pressures, helping households avoid debt traps during tough financial stretches. Parents across the nation have called it a game-changer, describing it as essential relief amid rising costs.

Understanding the Cash Boost Mechanism

The Centrelink advance payment lets eligible recipients access a lump sum from their Family Tax Benefit or income support upfront. Unlike loans, it carries no interest or fees, with repayments spread over 13 fortnightly installments through minor deductions. Families favor this option for its simplicity, especially around January when school starts and bills pile up. Over a million families tapped into it last year, proving its popularity for immediate needs like uniforms and books.

Impact on Everyday Family Budgets

For single parents juggling childcare and groceries, the boost acts as a critical buffer. It covers gaps left by inflation, where essentials like power and food keep climbing. Many recipients report using it to stock up on supplies without maxing out credit cards, preserving long-term financial health. This advance isn’t just cash—it’s breathing room that lets families focus on what matters most.

Key Payment Types Affected

| Payment Type | Maximum Fortnightly Boost (2026) | Typical Use Case |

|---|---|---|

| Family Tax Benefit A | Up to $200 lump sum | School uniforms, stationery |

| Parenting Payment | $15-25 increase | Childcare, household bills |

| Youth Allowance | $684.20 (single, no dependents) | Rent, study materials |

| Child Care Subsidy | Variable per child | Early education fees |

Why Families Call It Essential

Parents share stories of the boost arriving just in time for school zones buzzing with last-minute shoppers. One mum noted it prevented her from skipping meals to buy shoes, while a dad praised its role in keeping kids in after-school programs. In a cost-of-living crunch, this support underscores government efforts to shield vulnerable groups. It’s not a handout but a smart tool that repays itself without extra burden.

Eligibility and How to Access It

Anyone on Family Tax Benefit, Parenting Payment, or similar can check eligibility via myGov or the Centrelink app. Updating income and family details ensures accurate amounts and avoids overpayment debts. The process takes minutes, with funds hitting accounts swiftly. Services Australia urges refreshing estimates yearly, especially post-holidays, to maximize benefits.

Broader Economic Role in 2026

As inflation lingers, the 2026 indexation lifts payments for over a million Aussies, including students and carers. This cash flow eases pressure on low-income homes hit hardest by housing and medical hikes. Economists see it stabilizing spending, preventing wider ripples like reduced local business trade. Families aren’t just surviving—they’re planning ahead with this reliable aid.

Challenges and Tips for Maximizing Support

While transformative, not everyone qualifies, and repayments require steady budgeting. Experts recommend pairing the boost with expense trackers to stretch every dollar. Keeping Centrelink details current dodges surprises, ensuring smooth sailing. For many, it’s the difference between stress and stability in an unpredictable economy.

FAQs

Q: Who qualifies for the cash boost?

A: Recipients of Family Tax Benefit, Parenting Payment, or Youth Allowance—check via myGov.

Q: Does it cost anything extra?

A: No interest or fees; repaid via small deductions over 13 pays.

Q: When do payments increase?

A: Automatic from January 1, 2026, for indexed amounts.

Disclaimer

The content is intended for informational purposes only. You can check official sources; our aim is to provide accurate information to all users.