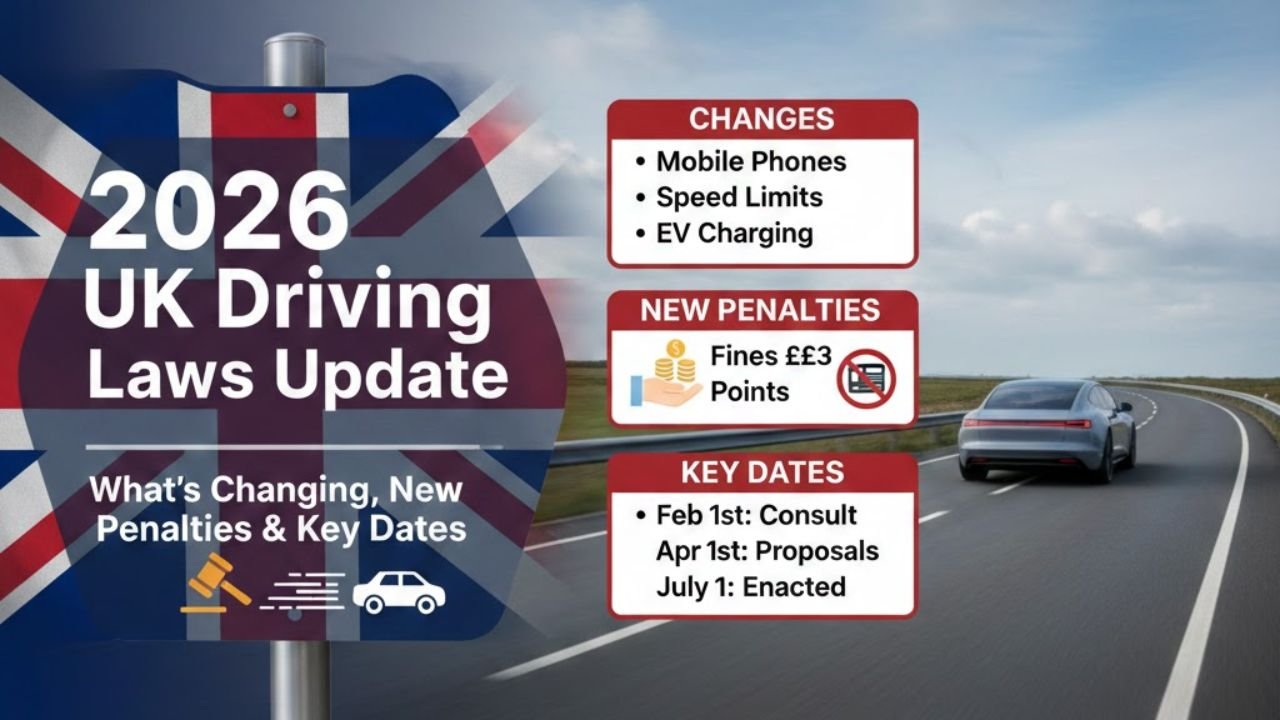

The year 2026 marks a transformative period for motorists in the United Kingdom. As the government accelerates its transition toward “Net Zero” and modernizes road safety protocols, several long-standing rules are being rewritten. From the end of tax exemptions for electric vehicles to stricter digital booking systems for new drivers, the landscape of British motoring is shifting. Staying informed is no longer optional—it is a financial necessity to avoid unexpected penalties and rising costs.

Tax Reforms: The End of the EV “Free Ride”

For years, electric vehicle (EV) owners enjoyed a total exemption from Vehicle Excise Duty (VED), but 2026 represents the first full year where this benefit has vanished. As of April 2025, the exemption was removed, meaning that throughout 2026, EV drivers must pay a standard annual rate, currently set at £195, which is expected to rise to £200 with inflation. However, there is a silver lining for those purchasing premium electric models. The “Luxury Car Tax” threshold, or the expensive car supplement, has been increased from £40,000 to £50,000 exclusively for zero-emission vehicles. This change ensures that mid-range family electric SUVs do not incur the additional £425 annual surcharge that still plagues petrol and diesel owners.

New DVSA Booking Rules and Test Updates

The Driver and Vehicle Standards Agency (DVSA) is implementing radical changes to the practical driving test booking system starting in Spring 2026. In an effort to combat “bot” accounts and the resale of test slots by driving schools, learner drivers must now book their own tests through the official portal; instructors are no longer permitted to book on a pupil’s behalf. Furthermore, learners are now limited to just two changes of their test date or location. If you exceed this limit, the booking is cancelled, and the fee is forfeited. The theory test is also evolving to include mandatory questions on CPR and the use of Automated External Defibrillators (AEDs), reflecting a national push for roadside life-saving skills.

2026 Motoring Changes at a Glance

| Category | Change / Regulation | Effective Date |

| Electric Vehicle Tax | Standard VED rate of ~£200 applies | April 2026 |

| Luxury Car Threshold | Limit raised to £50,000 for EVs only | April 2026 |

| Driving Test Booking | Learners must book personally; 2-change limit | Spring 2026 |

| Theory Test | Mandatory CPR & First Aid questions | Early 2026 |

| Fuel Duty | Proposed end of 5p-per-litre freeze | September 2026 |

| Fuel Finder Scheme | Mandatory real-time pump price reporting | February 2026 |

Fuel Pricing Transparency: The Fuel Finder Scheme

In February 2026, the government officially launched the “Fuel Finder” scheme. This law requires nearly all petrol station operators to report their current pump prices to a central database within 30 minutes of any change. The initiative targets “rocket and feather” pricing—where prices rise quickly but drop slowly—aiming to save drivers between 1p and 6p per litre by fostering open competition. While this provides some relief, motorists should prepare for September 2026, when the long-standing 5p-per-litre fuel duty cut is under review and widely expected to expire, potentially driving prices back up at the pump.

Enhanced Penalties and Digital Enforcement

Road safety enforcement is becoming increasingly automated in 2026. The police have been granted expanded powers to use AI-controlled camera systems capable of identifying 3D and 4D “ghost” number plates designed to evade ANPR. Penalties for driving without a valid MOT or insurance have also been streamlined, with higher fines and simplified vehicle seizure procedures. For those with a heavy right foot, the tiered speeding fine system remains strict; serious offenders can face fines of up to 175% of their weekly income, capped at £2,500 for motorway offences.

Zero Emission Mandates and Urban Charges

The Zero Emission Vehicle (ZEV) Mandate enters a stricter phase in 2026, requiring manufacturers to ensure that at least 52% of their new car sales are zero-emission. While this increases the availability of EVs, driving them in urban centers is becoming more expensive. In London, the final “Cleaner Vehicle Discount” for the Congestion Charge has expired, meaning even EV drivers must now pay the full daily rate. Meanwhile, cities like Oxford are considering expanding their Zero Emission Zones (ZEZ) to cover entire city centers, where only fully electric vehicles can enter for free, while petrol and diesel cars face daily entry fees.

Looking Ahead: Health Checks and New Tech

As part of the 2026 Road Safety Strategy, the government is consulting on mandatory professional eye tests for drivers over the age of 70 during license renewals. This move aims to ensure medical fitness in an aging population. Additionally, from late 2026, all newly registered vehicles must comply with Euro 7 emission standards. While these standards significantly reduce tailpipe pollutants, industry experts warn they may lead to a slight increase in the purchase price of new internal combustion engine (ICE) vehicles as manufacturers integrate more complex filtration technology.

FAQs

Q1 Do I have to pay road tax for my electric car in 2026?

Yes. The previous exemption has ended. Most EV owners will pay a standard rate of approximately £195 to £200 per year, depending on the inflation adjustment in the April Budget.

Q2 Can my driving instructor still book my test for me?

No. As of the Spring 2026 update, learners must manage their own bookings through the GOV.UK portal to prevent the mass-booking and resale of slots by third parties.

Q3 What is the new “Fuel Finder” law?

It is a mandatory scheme where petrol stations must report price changes to a central government database within 30 minutes, allowing drivers to use apps to find the cheapest local fuel in real-time.

Disclaimer

The content is intended for informational purposes only. You can check the official sources as our aim is to provide accurate information to all users.